Overall market sentiment is usually determined by looking at long-term market behavior. However, while minimizing can put current market conditions in a much better perspective, sometimes the most solid measure of market position lies in the middle.

SOPR and its value in market analysis

The Output Spent Profit Ratio (SOPR) is a useful metric for determining overall market sentiment. As its name suggests, the metric compares the value of the output when it was spent when it was created. The scale shows the degree of profit made for all the coins that were moved on the chain in a given time frame.

When the SOPR exceeds one, the respective coins deal with a profit. When the ratio is less than one, the currencies are dealing with a loss. SOPR 1 is called SOPR reset and is often used to indicate the beginning or end of a mid-term cycle. A SOPR reset can also act as support in bull markets or resistance in bear markets.

While the gauge is an initial and easy to interpret signal, it can be modified further to provide a more complex view of the market.

For example, transactions are filtered to remove any “inside” activity (for example, transactions between addresses belonging to the same owner) through aSOPR, which shows better market signals when compared to raw data standards (SOPR). SOPR and aSOPR can be divided into groups of long and short term owners.

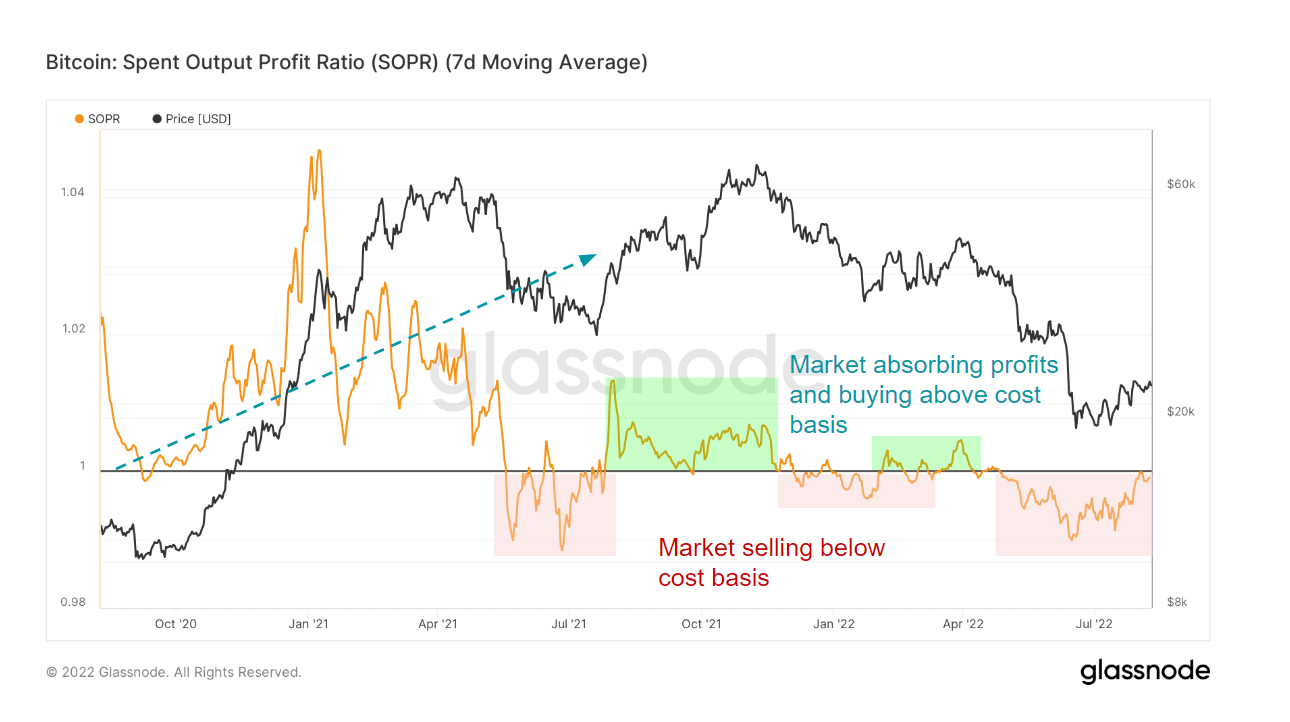

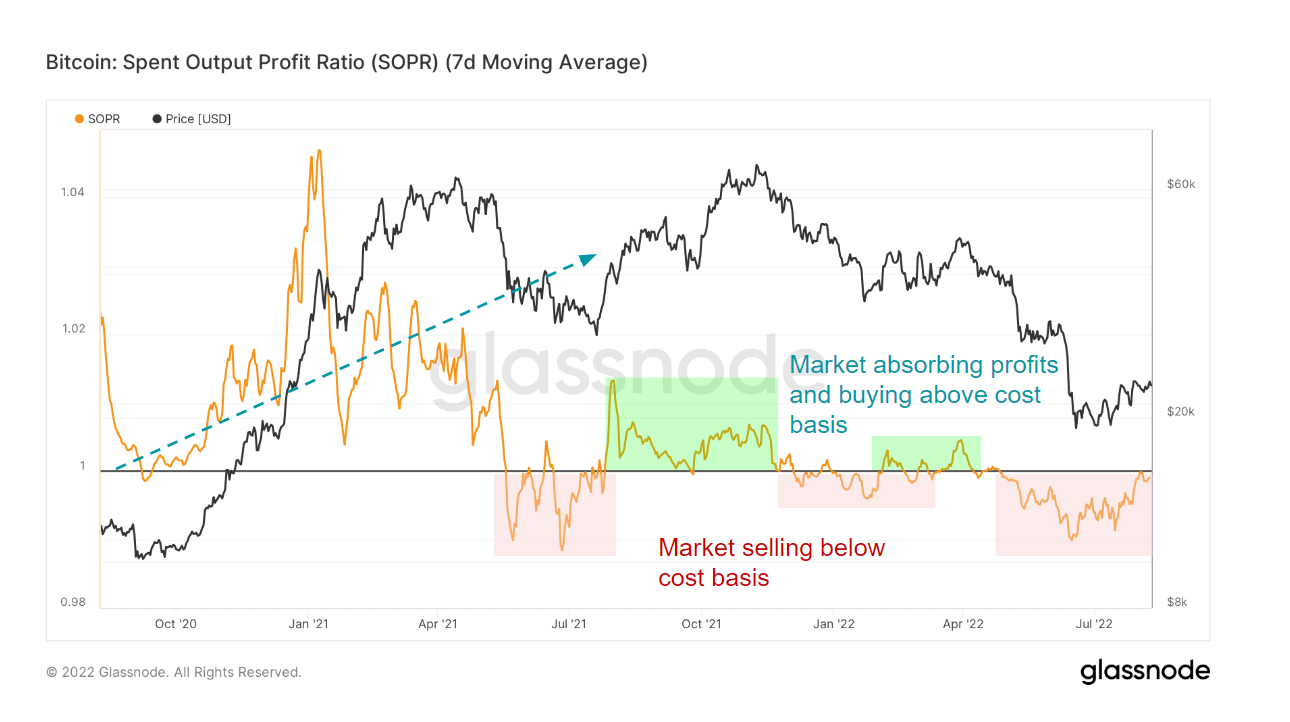

SOPR for Bitcoin

For the first time since May, the 7-day MA SOPR of Bitcoin attempted to break above 1. At the end of July, one Bitcoin SOPR touched and was retested throughout the first week of August.

Every time Bitcoin hit the SOPR level of 1 and failed to break the resistance; Its price has increased slightly. Attempts to break SOPR resistance are always associated with a bear market rally, sometimes referred to as a dead cat bounce.

Although Bitcoin’s unsuccessful attempts to break through resistance may appear pessimistic, the outlook is positive. Historically, SOPR has always required many attempts to break above 1. The more it struggles to break through 1 ratio, the stronger the support it gets later on.

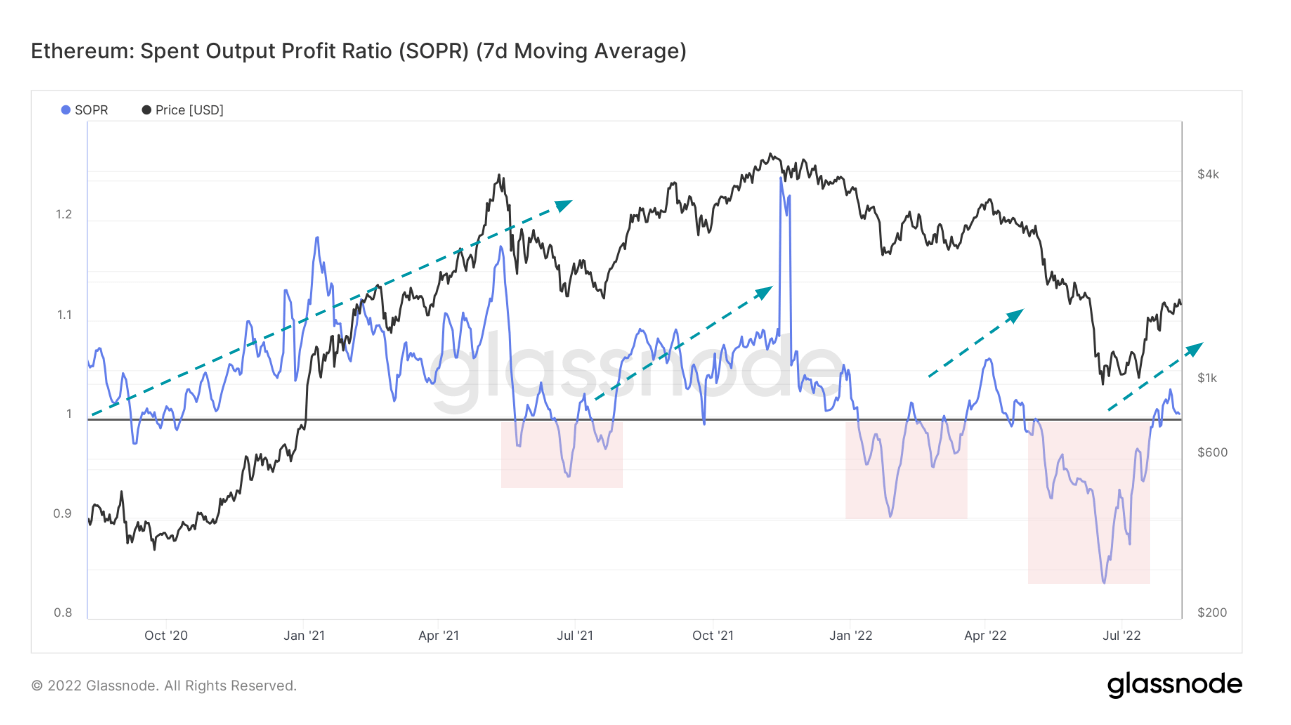

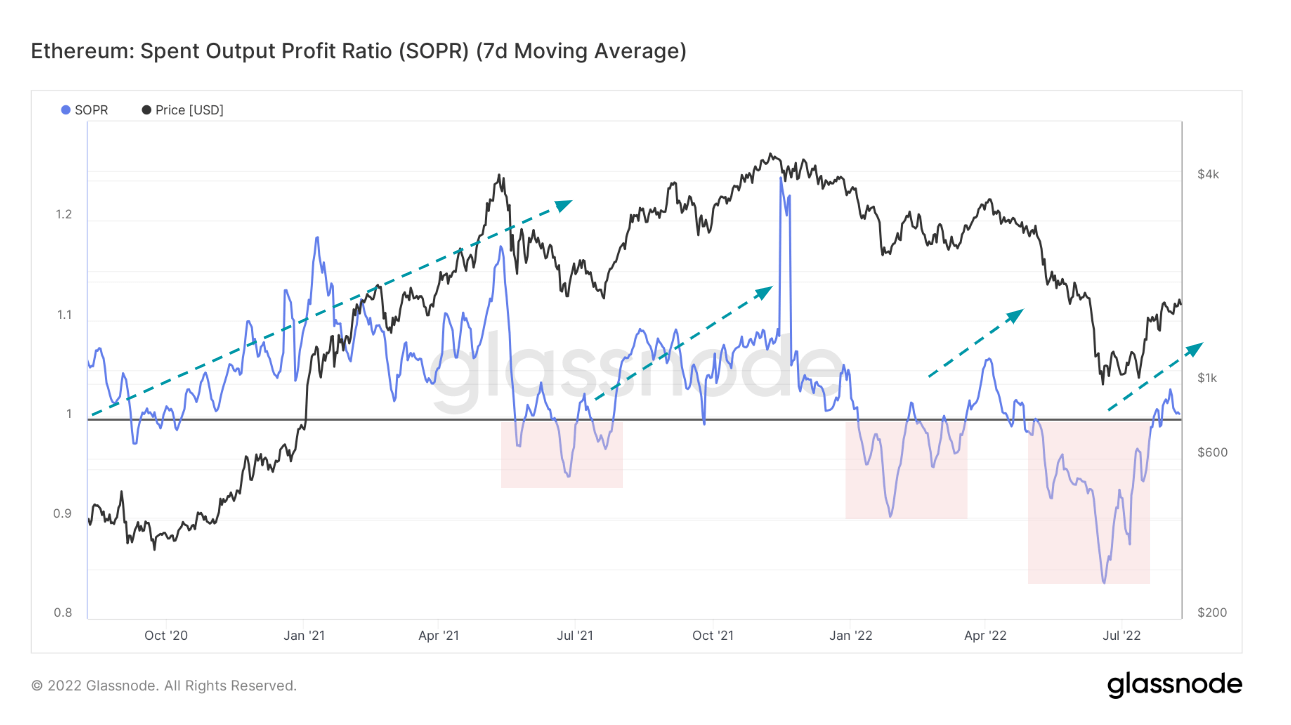

SOPR in Ethereum

Unlike Bitcoin, Ethereum managed to break through the SOPR 1 level on the first try. As of August, Ethereum appears to have found support at 1, with data from glass It appears that she quickly recovered from her last drop. Ethereum’s surging SOPR is a direct result of the ETH price rally, which has been challenging a broader market trend that has kept most coins in the red.

However, while Bitcoin is retesting its resistance, Ethereum is retesting its support, which indicates that the two could move in opposite directions. Historically, for the EPW ratio to act as a strong support, the ratio would have to pass through resistance multiple times in order to act as a support.

As previously Covered By CryptoSlate, the market-challenging Ethereum rally is largely the result of speculation about the upcoming merger. This is seen in a significant increase in derivatives trading, which has pushed open interest on Ethereum to $6.4 billion – $1.4 billion more than open interest on Bitcoin. The rise in derivatives trading contrasts with the decline in user activity on the network, as shown by the decline in gas fees.

This amount of speculation puts the stability of Ethereum’s SOPR at risk. Any weaknesses in the Ethereum price will definitely affect the ratio and push it below 1. If it were to drop suddenly, Ethereum’s SOPR could find strong resistance if it tries to break above the level again.